|

|

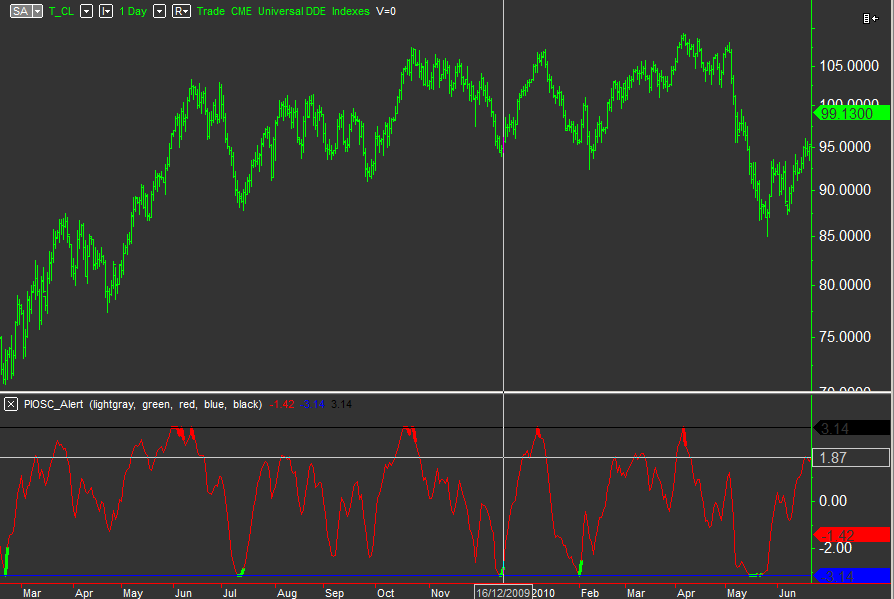

PI-OSC ON CL OIL FUTURES METHOD OF DETERMINATION TO USE OR NOT.

I was looking through the signals generated with Precision Index Oscillator on daily CL and was trying to understand why some areas of the date range were better than others. I noticed in 2009 there were 8 consecutive wins in a row and all very precisely aligned with the tops and bottoms but then more recently some of the signals were not so good.

How can one know in advance if a signal is good or not, and decide when to trade them or not?

You cant know in advance how the market will behave tomorrow and that is what makes trading difficult. It also makes it very interesting. To be statistically profitable one must have a good exit strategy in place that both allows for the pull backs after minor profits are seen and also bails out if the required price action is not found.

Generally with Pi-Osc signals it is wise to select markets that have shown many previously profitable signals and also to ensure the very long term trend is in the same direction as the signal. The choice of time frame is also important as slower time frames produce bigger swings and are generally more reliable.

Hope this helps