|

|

SWING TRADING WITH THE PI OSCILLATOR VS. TRADITIONAL INDICATORS

The suggested use of the Pi Oscillator is to use it as a reversal-entry indicator. Like any indicator, it is not a strategy. But, it can be part of a strategy. I informed Mr. Medcalf (the creator of the Pi Oscillator) that it seemed to me that the indicator can be useful in more ways than just informing when an extreme overbought or oversold condition has been reached. The usefulness could be increased by adding a zero line and lines at +/- Pi/2 (1.57) to the existing lines at +/- Pi (3.14). He, quite reasonably, said: “show me.”

I expect any indicator to give me information that makes me money. Otherwise, it is creating confusion and should be removed from the chart. I also expect that if I am going to purchase an indicator then it should do something that free indicators do not do. So, I decided to compare its performance on a maddening problem that I would like to solve…avoiding being shaken out of an uptrend. One of the most common problems of traders is taking profits too soon. I have found it to be a tougher challenge to overcome than the most widely recognized problem…not using or honoring a stop.

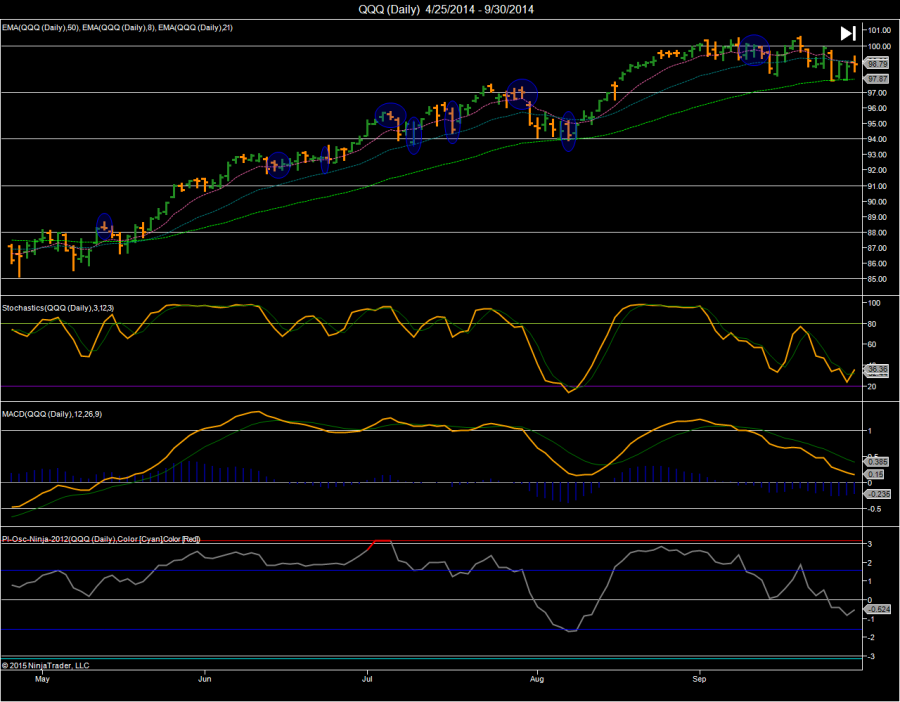

Here is an uptrend in the Nasdaq 100 index (QQQ) that lasted 4 months during 2014. During that time, the price rose from around $88 to around $100…a gain from breakout to peak of more than 13%. But, how much of that could you actually earn and keep? How would you know when to get in and when to get out? How would traditional indicators have fared? Would the Pi-Oscillator justify its purchase?

First, I can join other commenters and state that the Pi Oscillator when it reaches +/- 3.14 does do a good to great job of indicating potential reversal-entries, if you follow the rule to wait for price to move away in the reverse direction before entering. This is the only ‘officially sanctioned’ use of the Pi Oscillator. How well did the Pi Oscillator do its ‘official’ job in this particular instance? It gave one overbought signal after the close on 7/2/14 (4th ellipse), after which price never moved sufficiently down to warrant a short entry. The large down day on 7/8/14 may have induced some to enter, and they would have been soon stopped out for a loss. So, in this particular period of time on this particular widely followed instrument, the Pi Oscillator was of no help. Or was it?

The chart includes some of the most common/generic indicators: 8, 21, and 50 period Exponential Moving Averages, a Stochastic (12,3,3), and a MACD (12,26,9).

If you’ve spent any time on this site, you know that EMA’s lag badly. The novice trader’s first thought to enter when the MA’s cross above each other and exit on a cross down will not work. Despite the EMA’s being ‘in gear’ for much of this time on the chart, they would have you both entering and exiting late. You would both miss out and give back much of the upward movement of this text book trend, and then go broke during a non-trending period. There may be value in using these EMA’s as a trend filter, or as part of a system.

How about the stochastics? Once one realizes that EMA crossovers do not work, the novice next moves on to stochastic crossovers. Between the breakout to a new high (first ellipse) on 5/12/14 and the September 2014 peak, there are 11 pairs of stochastic crossover signals. Here is a beautiful uptrend and you are getting whipsawed to death.

How about the MACD? It is smoother and only has 4 crossover signals. But, it would have you exit around the second ellipse on 6/16/14 at $92.16, then re-enter long just before the fourth ellipse at the open on 7/2/14 at $94.98…which is the day that the Pi Oscillator reached Pi and became extreme overbought! Not only did you miss an entire segment of the move, but you got in just in time to see the market pullback more than 2% against your position on 7/7/14 and 7/8/14 (fourth ellipse). The MACD crossover gives you an exit signal to get out at a very small loss after the close on 7/10/14 at $94.87 (fifth ellipse). The QQQ then immediately proceeds to resume the uptrend. The MACD crossover doesn’t tell you to get back in long again until the open of 7/24/14 at $97.40 (between the sixth and seventh ellipse), which just so happens to be a major short term peak! This process of getting in late and getting out at the wrong time occurs again and again. The best things we can say about the MACD are that it (like the EMA’s) has some value as a trend filter, and you will go broke more slowly than if you follow the stochastics…that is if the frustration from missing out on moves doesn’t cause you to abandon your trading plan and have guaranteed disaster quickly commence.

So, what can we do? This looks so easy in hindsight. Buy low and sell high. The only ones getting rich as you try to chase every wiggle and squiggle are your broker and the person taking the other side of your trade. Will the Pi Oscillator help?

I have highlighted 9 days with a blue ellipse.

1. 5/12/14. We go long on a breakout to a new high of $88.16. Anecdotally, I have heard that about 25% of successful breakouts just take off. The other 75% of successful breakouts will pullback first. One could advocate a plan that waits for a pullback to occur and enters instead on 5/19/14 at $87.77. In either case, an entry would not hit a reasonably placed stop and we are long. All three potential trend filters: the MACD, 50 EMA, and Pi Oscillator(>0) support a long entry.

2. 6/13/14. Traders that rather than wait for a stochastic crossover instead plan to exit with a stochastic move below the overbought/80 line will be getting out. The MACD signal line crossover also soon signals an exit. But, the Pi Oscillator is hanging in there above the Pi/2 (1.57) level. We stay long.

3. 6/24/14. Those poor stochastic followers are getting whipsawed again…getting out when it would be a great time for those that missed the initial run-up to enter. The Pi Oscillator has remained above 1.57.

4. 7/2/14. The Pi Oscillator gives an extreme reading (red bar). We trail our stop more closely, at just below the low of the day. We exit on 7/8/14 at 95.22 for a profit of about 8%.

5. 7/10/14. The Stochastic and the MACD are in a sell, but the Pi Oscillator has pulled back to support at Pi/2(1.57). We also have a candle that closes near the top of its range after bouncing off the 21 EMA. We go long the next day 7/11/14 above today’s high at $95.06.

6. 7/17/14. The Pi Oscillator closes below Pi/2. We move our stop to below the low of the day and trail upwards below the low of the day as long as the Pi Oscillator is below Pi/2. Price bounces off the 21 EMA yet again and we remain long.

7. 7/29/14. The Pi Oscillator closes below Pi/2 so a stop is trailed below the low of the day. The stop is hit on the open of 7/31/14 at $96.20 for a gain of 1.2%.

8. 8/7/14. The market finds support at the 50 EMA and the -Pi/2 (-1.57) level. This is a low risk entry. We will enter above the high of the day and then place a stop below the low of the day. We enter at the open on a gap up on 8/11/14 at $95.25.

9. 9/10/14. The Pi Oscillator closes below Pi/2 and we trail our stop below the low of the day. We exit on the third of the three bars in the ellipse on 9/12/14 at $99.23 for a gain of 4.2%. Alternatively, one might have expected round number resistance and exited earlier at $100. You may also notice that price subsequently briefly finds support on 9/15/14 at the Pi=0 level.

In 3 trades during 4 months with minimal expenditure of time, the Pi Oscillator with some help from rational stop placement, and an intermediate level understanding of reading price action could’ve captured the whole 13% move. Will it always work this well? Of course not. Whatever you are trading needs to move/trend. But, I do think the Pi Oscillator can be a very helpful indicator and comprise an important part of a trading strategy.

I expect any indicator to give me information that makes me money. Otherwise, it is creating confusion and should be removed from the chart. I also expect that if I am going to purchase an indicator then it should do something that free indicators do not do. So, I decided to compare its performance on a maddening problem that I would like to solve…avoiding being shaken out of an uptrend. One of the most common problems of traders is taking profits too soon. I have found it to be a tougher challenge to overcome than the most widely recognized problem…not using or honoring a stop.

Here is an uptrend in the Nasdaq 100 index (QQQ) that lasted 4 months during 2014. During that time, the price rose from around $88 to around $100…a gain from breakout to peak of more than 13%. But, how much of that could you actually earn and keep? How would you know when to get in and when to get out? How would traditional indicators have fared? Would the Pi-Oscillator justify its purchase?

First, I can join other commenters and state that the Pi Oscillator when it reaches +/- 3.14 does do a good to great job of indicating potential reversal-entries, if you follow the rule to wait for price to move away in the reverse direction before entering. This is the only ‘officially sanctioned’ use of the Pi Oscillator. How well did the Pi Oscillator do its ‘official’ job in this particular instance? It gave one overbought signal after the close on 7/2/14 (4th ellipse), after which price never moved sufficiently down to warrant a short entry. The large down day on 7/8/14 may have induced some to enter, and they would have been soon stopped out for a loss. So, in this particular period of time on this particular widely followed instrument, the Pi Oscillator was of no help. Or was it?

The chart includes some of the most common/generic indicators: 8, 21, and 50 period Exponential Moving Averages, a Stochastic (12,3,3), and a MACD (12,26,9).

If you’ve spent any time on this site, you know that EMA’s lag badly. The novice trader’s first thought to enter when the MA’s cross above each other and exit on a cross down will not work. Despite the EMA’s being ‘in gear’ for much of this time on the chart, they would have you both entering and exiting late. You would both miss out and give back much of the upward movement of this text book trend, and then go broke during a non-trending period. There may be value in using these EMA’s as a trend filter, or as part of a system.

How about the stochastics? Once one realizes that EMA crossovers do not work, the novice next moves on to stochastic crossovers. Between the breakout to a new high (first ellipse) on 5/12/14 and the September 2014 peak, there are 11 pairs of stochastic crossover signals. Here is a beautiful uptrend and you are getting whipsawed to death.

How about the MACD? It is smoother and only has 4 crossover signals. But, it would have you exit around the second ellipse on 6/16/14 at $92.16, then re-enter long just before the fourth ellipse at the open on 7/2/14 at $94.98…which is the day that the Pi Oscillator reached Pi and became extreme overbought! Not only did you miss an entire segment of the move, but you got in just in time to see the market pullback more than 2% against your position on 7/7/14 and 7/8/14 (fourth ellipse). The MACD crossover gives you an exit signal to get out at a very small loss after the close on 7/10/14 at $94.87 (fifth ellipse). The QQQ then immediately proceeds to resume the uptrend. The MACD crossover doesn’t tell you to get back in long again until the open of 7/24/14 at $97.40 (between the sixth and seventh ellipse), which just so happens to be a major short term peak! This process of getting in late and getting out at the wrong time occurs again and again. The best things we can say about the MACD are that it (like the EMA’s) has some value as a trend filter, and you will go broke more slowly than if you follow the stochastics…that is if the frustration from missing out on moves doesn’t cause you to abandon your trading plan and have guaranteed disaster quickly commence.

So, what can we do? This looks so easy in hindsight. Buy low and sell high. The only ones getting rich as you try to chase every wiggle and squiggle are your broker and the person taking the other side of your trade. Will the Pi Oscillator help?

I have highlighted 9 days with a blue ellipse.

1. 5/12/14. We go long on a breakout to a new high of $88.16. Anecdotally, I have heard that about 25% of successful breakouts just take off. The other 75% of successful breakouts will pullback first. One could advocate a plan that waits for a pullback to occur and enters instead on 5/19/14 at $87.77. In either case, an entry would not hit a reasonably placed stop and we are long. All three potential trend filters: the MACD, 50 EMA, and Pi Oscillator(>0) support a long entry.

2. 6/13/14. Traders that rather than wait for a stochastic crossover instead plan to exit with a stochastic move below the overbought/80 line will be getting out. The MACD signal line crossover also soon signals an exit. But, the Pi Oscillator is hanging in there above the Pi/2 (1.57) level. We stay long.

3. 6/24/14. Those poor stochastic followers are getting whipsawed again…getting out when it would be a great time for those that missed the initial run-up to enter. The Pi Oscillator has remained above 1.57.

4. 7/2/14. The Pi Oscillator gives an extreme reading (red bar). We trail our stop more closely, at just below the low of the day. We exit on 7/8/14 at 95.22 for a profit of about 8%.

5. 7/10/14. The Stochastic and the MACD are in a sell, but the Pi Oscillator has pulled back to support at Pi/2(1.57). We also have a candle that closes near the top of its range after bouncing off the 21 EMA. We go long the next day 7/11/14 above today’s high at $95.06.

6. 7/17/14. The Pi Oscillator closes below Pi/2. We move our stop to below the low of the day and trail upwards below the low of the day as long as the Pi Oscillator is below Pi/2. Price bounces off the 21 EMA yet again and we remain long.

7. 7/29/14. The Pi Oscillator closes below Pi/2 so a stop is trailed below the low of the day. The stop is hit on the open of 7/31/14 at $96.20 for a gain of 1.2%.

8. 8/7/14. The market finds support at the 50 EMA and the -Pi/2 (-1.57) level. This is a low risk entry. We will enter above the high of the day and then place a stop below the low of the day. We enter at the open on a gap up on 8/11/14 at $95.25.

9. 9/10/14. The Pi Oscillator closes below Pi/2 and we trail our stop below the low of the day. We exit on the third of the three bars in the ellipse on 9/12/14 at $99.23 for a gain of 4.2%. Alternatively, one might have expected round number resistance and exited earlier at $100. You may also notice that price subsequently briefly finds support on 9/15/14 at the Pi=0 level.

In 3 trades during 4 months with minimal expenditure of time, the Pi Oscillator with some help from rational stop placement, and an intermediate level understanding of reading price action could’ve captured the whole 13% move. Will it always work this well? Of course not. Whatever you are trading needs to move/trend. But, I do think the Pi Oscillator can be a very helpful indicator and comprise an important part of a trading strategy.

|

|

Thank you for your detailed example and screen shot, it shows a lot of careful thought.

Stochastic oscillators measure the percentage position over the length used so don't have much "market intelligence"

EG if the highest close was 100 and the lowest close was 50 and now the price is 75 over the period used then the stochastic will read around 50 if no smoothing is used. ( 100 + 50 ) = 150 then 75 as a percentage of 150 = 50%. In other words it is in the middle of its range. Once this calculation is understood then this leads its users to realize that this one of the most over rated indicators in the technicians tool kit.

MACD measures the distance between two moving averages and whilst it can give impressive signals in the smooth ebb and flowing markets of yesteryear it is of much less use these days with the high speed jagged electronic markets of the present.

I couldn't help but notice one confusing point regarding your described use of the above + 1.57 line to indicate an uptrend.

As Pi-Osc is built symmetrically then my conclusion would be that below the - 1.57 line would logically be used to signify a down trend in your described method.

On topic 8 you have remarked that you used the -1.57 line as a long entry as it was also a bounce from the exponential moving average. This implies a methodology which requires extra interpretation or could be called subjective.

My preference is to code a strategy in an objective way that it cannot ever be subjective to interpretation and if a flaw appears due to some oversight on my part then few new lines of code would be added to handle that scenario or flaw as an upgrade to that strategy.

Doing things in this way has the advantage of being able to back test quickly on many markets to find the generic "best" methods.

As I said before I am happy to add these lines for you as a bespoke offering but it would be cheaper for you to create an indicator yourself with three lines at + 1.57 , 0 and -1.57 and the overlay this on top of the Pi-Osc plot.

Pi-Osc is popular due to two reasons. 1. It does a good job of finding oversold and overbought conditions. 2. It is very simple to understand its use. If I added the extra lines to my public release offering it would likely cause a lot of confusion to my customers.

Thank you also for the information you send me about NinjaTrader 8